The Legal Framework Behind Offshore Trusts You Can’t Ignore

The Legal Framework Behind Offshore Trusts You Can’t Ignore

Blog Article

Discovering the Key Features and Benefits of Using an Offshore Trust for Riches Monitoring

When it pertains to riches administration, you could find that an offshore count on provides special benefits you had not considered. These counts on can boost property defense, offer tax effectiveness, and maintain your privacy. By recognizing their crucial attributes, you can make enlightened decisions regarding your monetary future. How do you choose the right territory, and what certain advantages could use to your scenario? Let's check out these important aspects further.

Recognizing Offshore Trusts: Meaning and Function

Offshore trusts work as effective devices for wealth administration, supplying individuals with critical choices for asset defense and tax performance. These trusts are lawful entities established in territories outside your home country, allowing you to safeguard your possessions from financial institutions, legal actions, and even possible taxes. By putting your wide range in an offshore depend on, you obtain a layer of security that could not be available domestically.

The key purpose of an offshore trust is to assist you preserve control over your possessions while ensuring they're managed according to your desires. You can designate recipients, define just how and when they obtain distributions, and also established problems for possession accessibility. Additionally, offshore trusts can enhance privacy given that they typically secure your financial information from public scrutiny. Recognizing these essentials can encourage you to make educated choices about your wealth management approach and explore the benefits of offshore counts on properly.

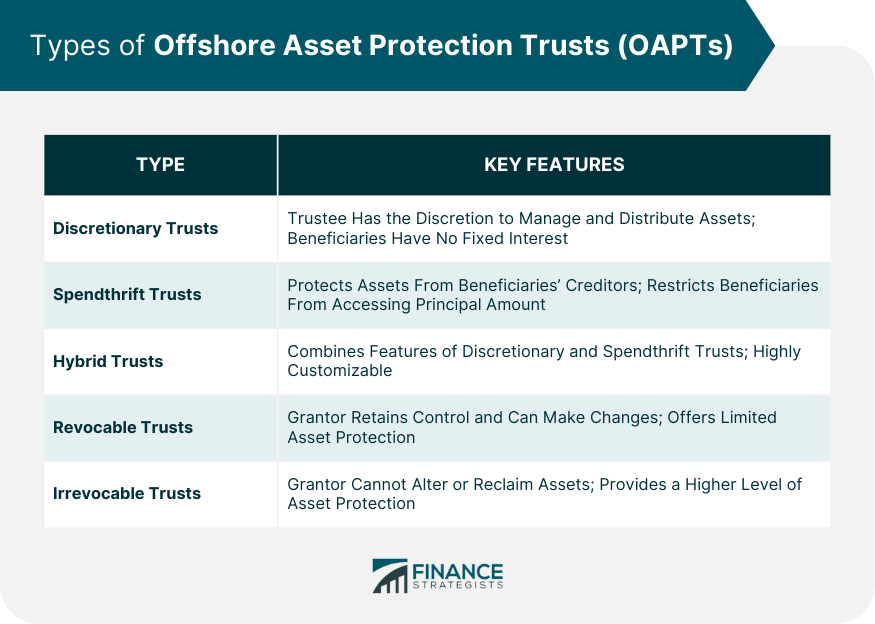

Trick Functions of Offshore Trusts

When thinking about offshore counts on, you'll discover 2 standout attributes: possession protection methods and tax efficiency advantages. These trust funds can secure your riches from legal insurance claims while likewise optimizing your tax obligation circumstance. Allow's explore exactly how these essential attributes can function to your advantage.

Property Security Approaches

One of the most compelling attributes of overseas trusts is their ability to safeguard possessions from possible lawful cases and financial institutions. When you establish an offshore trust fund, your possessions are held in a territory with solid personal privacy regulations and beneficial regulations. Additionally, overseas depends on usually provide a layer of defense versus political or financial instability in your home nation.

Tax Obligation Performance Advantages

Establishing an overseas depend on not just offers strong possession protection yet additionally presents considerable tax obligation efficiency advantages. By positioning your properties in an overseas trust, you can take advantage of positive tax obligation regimes that many territories offer. Eventually, an overseas count on can be an effective tool for optimizing your riches management technique.

Property Protection Perks

Given that you're looking to protect your wealth, understanding the property protection advantages of an offshore trust fund is essential. An overseas count on can shield your properties from lenders, lawsuits, and unanticipated financial difficulties. Offshore Trusts. By putting your wealth in this framework, you develop a legal barrier that makes it difficult for others to claim your possessions

Furthermore, overseas counts on usually operate under jurisdictions with durable personal privacy regulations, suggesting your economic info remains personal. This privacy can discourage prospective litigants or claimants from pursuing your possessions.

Tax Benefits of Offshore Trust Funds

While numerous capitalists seek ways to reduce their tax obligation responsibilities, offshore counts on can offer a tactical avenue for attaining tax benefits. By putting your assets in an overseas count on, you may take advantage of decreased taxes depending upon the jurisdiction's policies. Many overseas jurisdictions supply positive tax obligation rates or perhaps tax exceptions, permitting your wide range to expand without the problem of excessive taxes.

Additionally, overseas trusts can assist defer tax obligations on capital gains till circulations are made, offering you more control over when you recognize those gains. You might also have the ability to shield specific assets from taxes, depending upon the trust fund structure and regional laws. This browse around these guys versatility can improve your total wide range administration strategy.

Additionally, utilizing an overseas trust can help you navigate complicated worldwide tax obligation guidelines, making certain that you're compliant while maximizing your tax obligation placement. In short, overseas trust funds can be an effective tool in your wide range management arsenal.

Personal Privacy and Discretion Enhancements

When you established an offshore trust, you get boosted financial personal privacy that protects your possessions from undesirable examination. Legal confidentiality securities better guard your details from potential leaks and breaches. These features not just secure your wide range however likewise give assurance as you navigate your economic strategy.

Boosted Financial Privacy

Boosted monetary personal privacy is one of the crucial advantages of developing an overseas trust fund, as it enables you to secure your properties from prying eyes. By putting your wide range in an offshore trust fund, you can significantly lower the threat of unwanted examination from authorities or the public. Additionally, overseas territories usually have stringent personal privacy regulations that further shield your information from disclosure.

Legal Discretion Defenses

Offshore trusts not just supply improved economic personal privacy however also offer durable legal privacy protections that shield your assets from external examination. With offshore trust funds, you can safeguard your wide range versus legal challenges, financial institution cases, and various other risks while taking pleasure in the privacy you deserve in your wide range management approach.

Estate Preparation and Wealth Conservation

Estate planning and riches preservation are important for safeguarding your financial future and guaranteeing your possessions are shielded for generations to come. By developing an offshore trust fund, you can efficiently handle your estate, safeguarding your wealth from potential lenders and lawful obstacles. This aggressive strategy allows you to dictate just how your possessions are distributed, ensuring your wishes are recognized.

Using an offshore depend on additionally provides you with different tax obligation benefits, which can help optimize your wide range. You can reduce inheritance tax, enabling more of your wealth to be passed on to your beneficiaries. Furthermore, an overseas trust can secure your properties from political or financial instability, further securing your financial tradition.

Including an offshore depend on right into your estate preparation method not only enhances wealth preservation yet also brings satisfaction, knowing that your hard-earned assets will certainly be safeguarded for future generations.

Choosing the Right Jurisdiction for Your Offshore Trust Fund

Exactly how do you pick the right territory for your overseas trust? First, think about the legal framework. Try to find jurisdictions with strong possession defense laws and regulative security. This assures your depend on stays this page secure versus prospective review obstacles. Next, evaluate tax obligation ramifications. Some jurisdictions supply beneficial tax therapy, which can improve your wide range monitoring method.

You should also examine the credibility of the territory. A well-regarded place can enhance reputation and lessen analysis.

Frequently Asked Questions

Can I Establish up an Offshore Count On Without a Monetary Consultant?

Yes, you can establish up an offshore count on without an economic advisor, yet it's risky. You'll require to study lawful demands and tax ramifications completely to assure conformity and safeguard your assets successfully.

Are Offshore Trusts Legal in All Countries?

Offshore trusts are lawful in several nations, however not all. You'll need to inspect the certain legislations in your country and the jurisdiction where you prepare to develop the depend ensure compliance.

How Much Does It Expense to Establish an Offshore Trust?

Developing an offshore trust commonly costs between $2,000 and $10,000, depending upon factors like jurisdiction and intricacy. You'll likewise encounter continuous costs for management and compliance, so plan for those costs, too.

Can Beneficiaries Gain Access To Funds in an Offshore Trust Fund?

Yes, recipients can access funds in an overseas count on, yet it usually depends on the specific terms set by the count on. You need to assess those details to comprehend the gain access to regulations plainly.

What Happens if I Return to My Home Country?

If you move back to your home country, you'll need to consider local tax obligation effects and guidelines regarding offshore counts on. It's vital to get in touch with a lawful expert to navigate these changes successfully.

Report this page